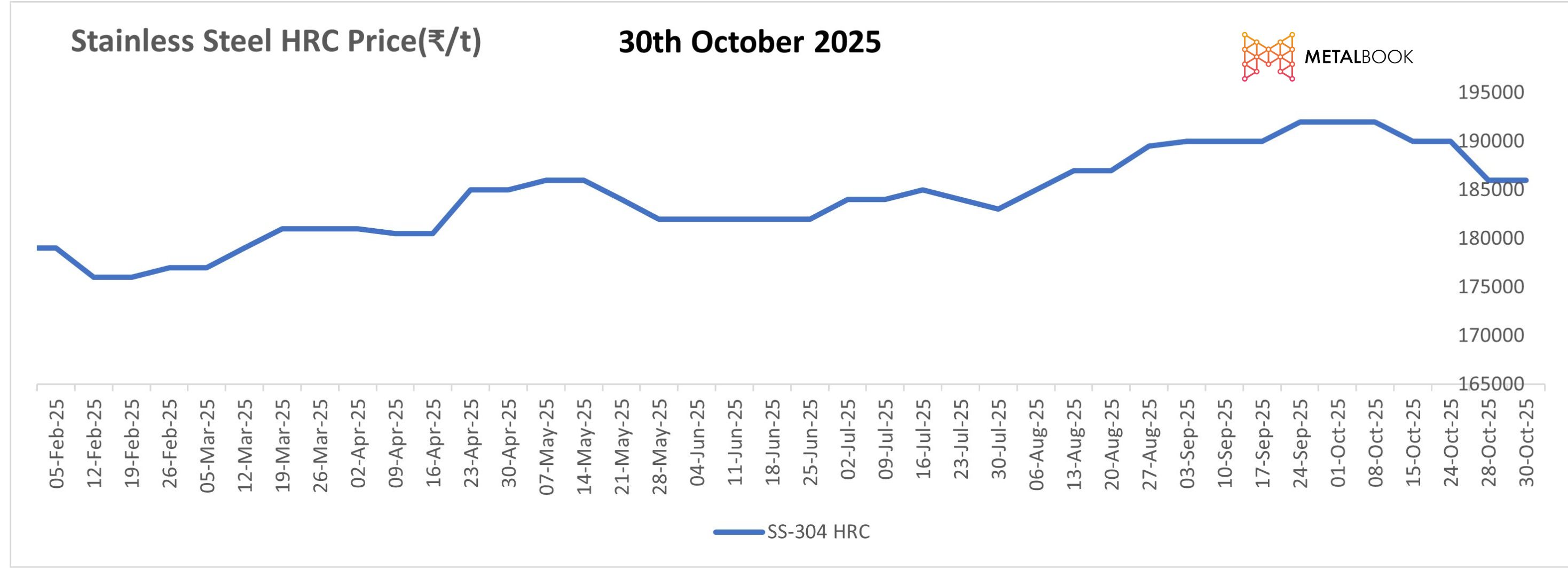

The price of stainless steel in India has continued to decline following the Diwali holidays due to weak demand and limited trading activity. The prices for significant grades, including the 304 series and 316 series, fell by ₹2,000–₹4,000/t as mills and traders reported that operations had restarted slowly, particularly in Gujarat. Prices of 304 HRC were assessed at ₹186,000/t, down ₹4,000/t, while 304L black round bars fell by ₹3,000/t to ₹157,000/t. Likewise, the price of 316 HRC and CRC fell by ₹2,000/t each, settling at ₹343,000/t and ₹348,000/t, respectively.

The ongoing BIS certification restrictions on Chinese suppliers have limited inflows, while Vietnamese imports, although available, have remained more expensive, reducing market competitiveness. Increasing freight rates ($1,400–1,500 per 20ft container) have put additional pressure on margins, making the economics of imports less favourable.

On the raw material aspect, declines in ferro molybdenum, ferro chrome, and ferro silicon indicate weak stainless-steel consumption and cautious mill restocking. The ferrous scrap market was also lacklustre due to both a low DRI price and limited bookings. Despite a modest increase in LME nickel prices, its support to domestic stainless steel is marginal at best as downstream demand recovery remains tepid.