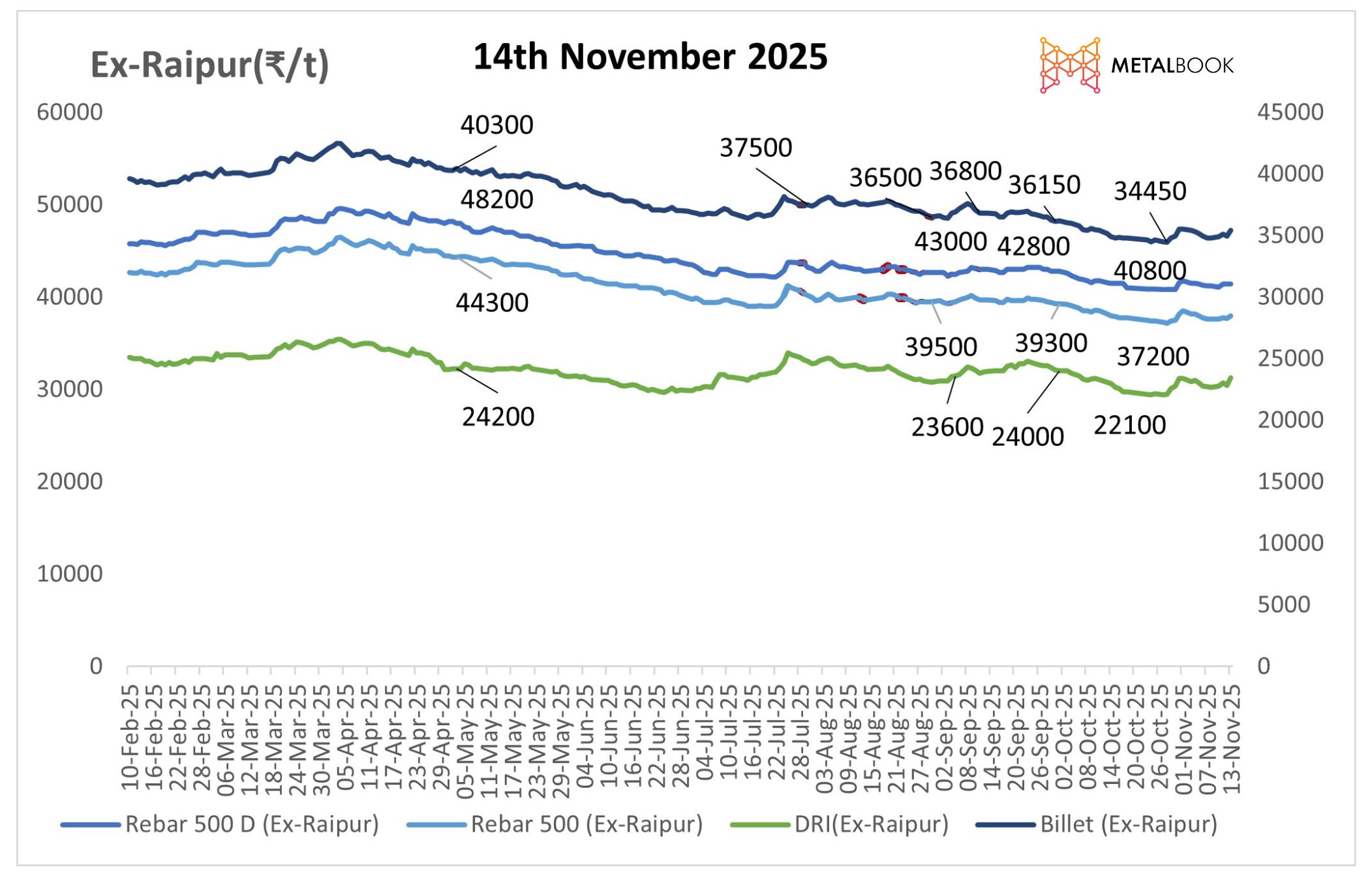

The market for Induction furnace steel in India has seen an overall increase in inquiry and moderate activity, resulting in a bullish trend for steel prices. Billet prices in Raipur increased by ₹450/t, which is one of the largest day-on-day increases we have seen across the major clusters in India. This increase in price was backed by strong local mills restock, sponge iron availability was moderate, and the demand from consuming regions did improve. Sponge iron prices in Chhattisgarh were mixed, trending upward or downward depending on freight increasing or decreasing, and the activity of regional dealers. Rebar (Fe 500) prices in Raipur held stable based on moderate construction-led buying and generally healthy booking orders that built over the previous few trading days. The manufacturers were in a firm offer situation based on stable order execution. The conversion spread from PDRI to billets stayed at ₹11,900/t in Raipur, suggesting stable margins for stand-alone induction furnace operations. These indications point to a positive sentiment in the Raipur steel market as buying activity improves, with an adequate supply chain and supplier inquiries for steel.

The outlook for Raipur still seems fundamentally nuclear for the immediate future. Market sources reported that a surge in inquiries, especially from re-rollers and buyers in the construction segment, is likely to keep prices for billets and rebars at strong levels. Additionally, as bookings for sponge iron continue to stay healthy, billet producers will likely maintain production levels, helping prices stay firm relative to the past week. As long as there is no sharp correction in raw material input prices or disruption in freight, steel prices in Raipur seem likely to move up or stay stable. With infrastructure activity remaining ongoing across Central India, and local distributors also noting some improvement in liquidity, the Raipur market will continue to be a bit more resilient in the Indian steel value chain. To summarize, steady demand, strong restocking, and a strong conversion spread continue to provide an overall positive near-term outlook for the Raipur IF steel market.