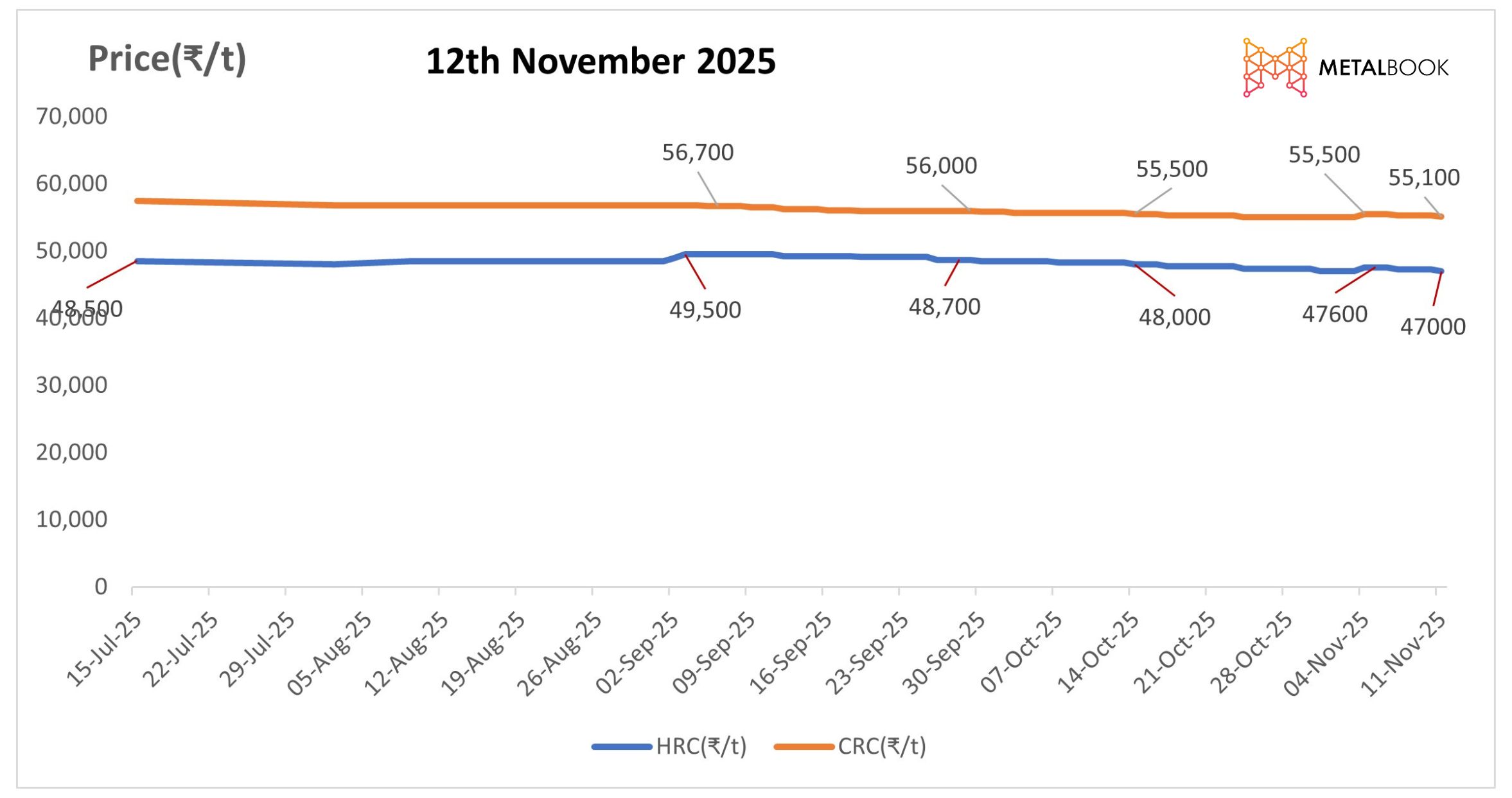

Prices for hot-rolled coil (HRC) in India decreased by ₹600/t week-on-week to ₹47,000/t in Mumbai, primarily due to weak demand, no liquidity, and quiet sentiment in trading. Distributors mentioned challenges in closing deals, as liquidity-related pressure limited transactions. No new offers or inquiries were reported in the market. In addition, India's bulk HRC imports were reported at 62,440 t as of 8 November 2025, with 137,500 t projected to arrive by the end of the month, which will increase supply availability in the domestic market and add further downward pressure on prices.

Outlook:

Domestic HRC prices are expected to remain range-bound over the near term as demand remains dull and liquidity issues persist. The timing of additional import arrivals is likely to continue putting pressure on domestic mills, so no recovery in pricing is expected. Trading is expected to remain limited, and weak sentiment in the market means prices are expected to remain constrained around current levels until demand improves in the domestic market.