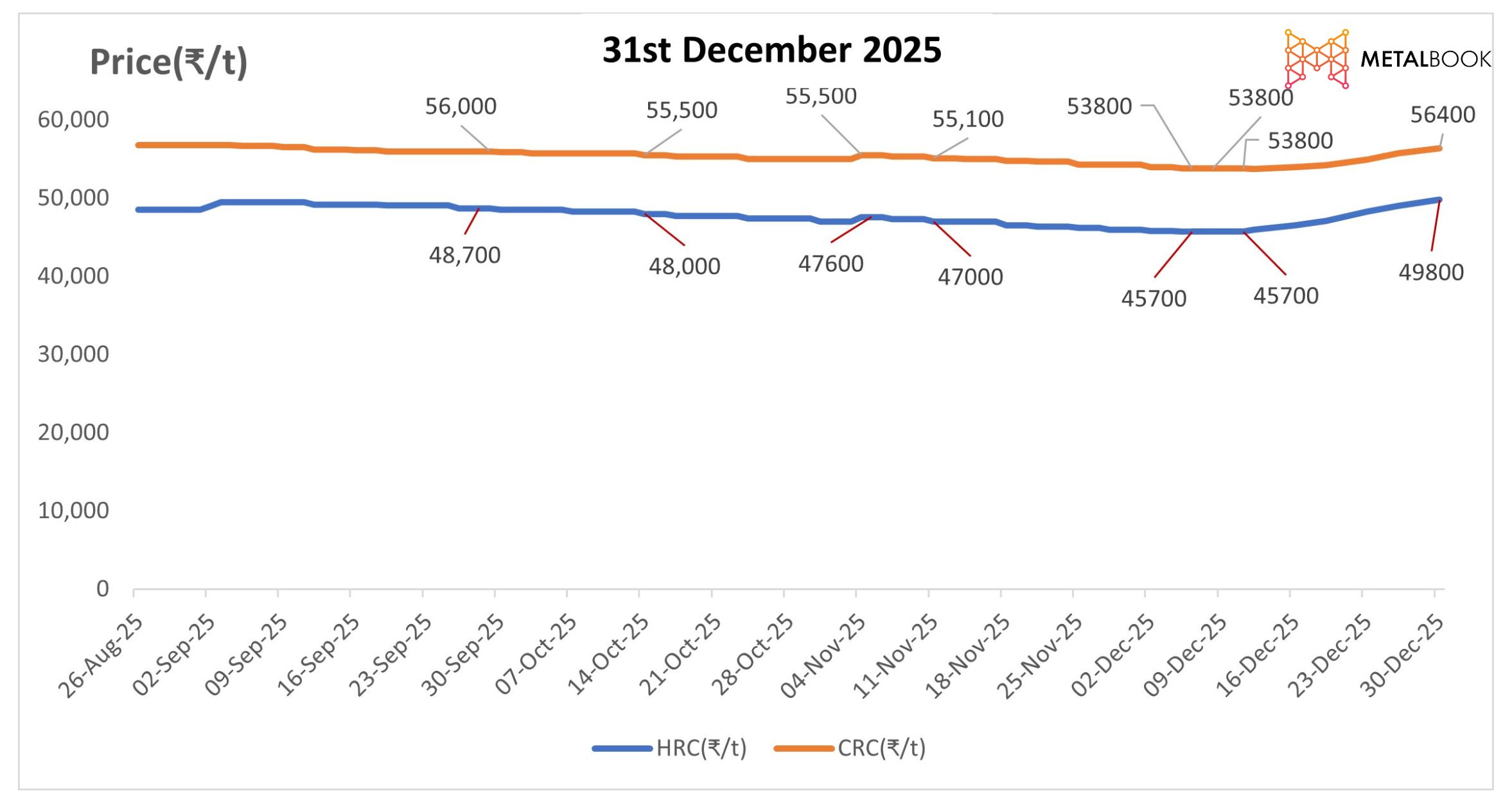

HRC and CRC prices ex-Mumbai in December 2025 remained largely range-bound, despite recent mill hikes, amid oversupply, and cautious buying sentiment. HRC prices were assessed ₹49,000–49,800/MT, while CRC prices hovered between ₹56,000–57,500/MT, excluding GST where applicable. As of 30th December, HRC (IS2062, Gr E250, 2.5–8mm/CTL) was assessed at ₹49,800/MT, up by ₹750–1,000/t in December. However, CRC (IS 513, CR1, 0.90mm/CTL) prices were assessed at ₹56,000–57,000/MT with trading at around ₹57,500–57,600/MT.

With the hike in mill price and firm raw material costs provided near-term support, the upward movement was capped by ample domestic supply, steady import inflows, and subdued demand during the monsoon and year-end period. HRC prices have remained lower, pressured by imports despite safeguard duties; on the other hand, CRC prices have shown relatively better stability, though slightly softer compared to September highs of ₹57,000–59,000/MT. Leading producers largely maintained December list prices versus late November, reflecting a cautious market stance.

Outlook

In the near term, HRC and CRC prices are expected to remain stable, supported by mill price and expectations of gradual demand recovery in early 2026. CRC is expected to outperform HRC, backed by steadier downstream demand, while HRC prices are likely to stay range-bound.